How to protect clients amid increasing HMRC enquiry activity

With enquiry activity increasing as HMRC pursues a £42 billion tax gap, and the department’s enquiry tactics...

READ MORE

Tim Pinkney and Bill Bewes share their knowledge and experience, answering five key questions to help accounting professionals improve compliance with anti-money laundering (AML) regulations and protect themselves and their clients.

IFA reviews have found 38% of firms are not compliant with money laundering regulations, and a recent Financial Accountant quiz found significant gaps in accounting professionals’ AML knowledge. Respondents were unclear about when to submit suspicious activity reports (SARs), what to do when customer due diligence findings are not satisfactory, what action to take when asked to transact with someone on a sanctions list, and more.

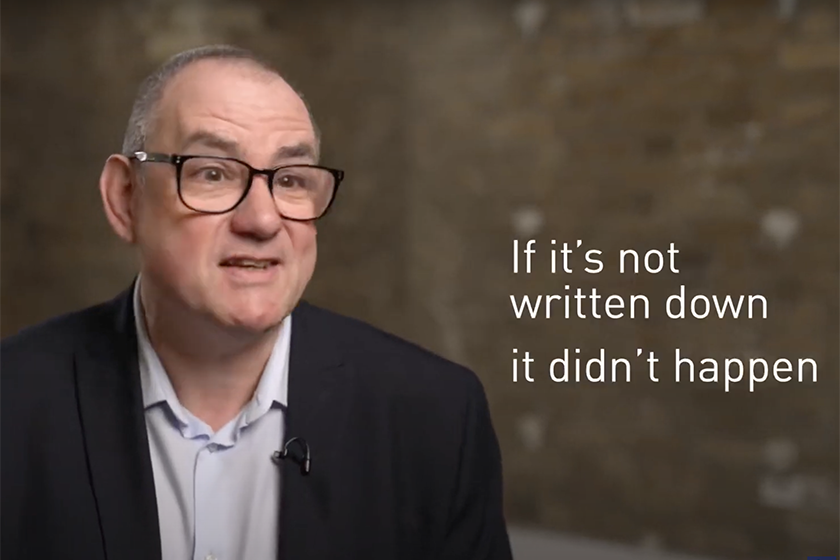

In this seven-minute video, IFA Director of Professional Standards Tim Pinkney and Head of AML and Compliance Bill Bewes share their knowledge and experience of anti-money laundering regulation and best practice. They offer practical guidance and advice to help accounting professionals to protect their firms and clients.

“Money laundering is the process whereby criminals retain, disguise and conceal the proceeds of their crimes,” Bewes explains. “It's the process that turns dirty money into funds that appear lawful and can be spent as if from legal sources.”

“Money laundering affects everybody. Remember, there's no such thing as a victimless crime,” Pinkney says. “In the UK, money laundering is defined in the Proceeds of Crime Act and covers the possession, transfer and acquisition of criminal property – be it from yourself or in relation to the conduct of a client.”

Pinkney says that, broadly speaking, firms should have:

“Our role is to apply a risk-based approach to our monitoring work, which includes AML reviews, training and appropriate enforcement action,” Bewes says.

In practice, Pinkney explains, this means that the IFA works with firms and practitioners to assess and improve policies and procedures. With the IFA’s help, firms and practitioners can make sure their policies meet the regulatory requirements and help keep firms safe from professional money launderers or criminals.

Pinkney explains that many practitioners will be taking the actions required on a day to day basis – but may be falling short in recording those actions.

“When you meet a client for the first time you almost certainly perform even a subconscious risk assessment,” he says. “You just need to take those observations and document them.

“Remember, from a law enforcement and supervisor point of view, if it's not written down it didn't happen.”

Bewes shares one very important step in protecting a practice: “We recommend that you develop a compliance culture and encourage you to engage a degree of professional scepticism.”

Bewes and Pinkney outline several ways that the IFA can assist members, including templates for risk assessments, policies and procedures, customer due diligence and more; AML workshops and events; collaboration to review and refine tailored policies; and more.

Join Tim Pinkney, Bill Bewes, National Crime Agency’s Emma-Jayne Turner, members of the IFA compliance team, industry partners and more for the IFA AML Conference online, 21 May 2024. Gain valuable insights from experts about AML regulatory updates and how to protect your business. Find out more.