How to protect clients amid increasing HMRC enquiry activity

With enquiry activity increasing as HMRC pursues a £42 billion tax gap, and the department’s enquiry tactics...

READ MORE

Last week, we published a short quiz to help readers assess their ability to respond to money laundering red flags. Here are the results – and expert advice to help you brush up.

“It’s essential that accounting professionals understand when and how to submit a Suspicious Activity Report (SAR),” says IFA Acting Director of Professional Standards Tim Pinkney.

“Accountants must put an air of professional scepticism on everything, and embed a culture of compliance that doesn’t treat the regulatory framework as a burden or a tick-box exercise. Meeting the compliance standards is the bare minimum you need to do to protect your firm, yourself and your profession – not the maximum.”

Pinkney says that compliance reviews often reveal which of three buckets a firm falls into:

“Some have their heads in the sand and they just think, ‘none of my clients are money launderers, I don't have any cash based dealings and I don't need to do anything’,” Pinkney says.

“But there are countless risks if you don’t have appropriate policies and procedures that are tailored to your firm, and which actually mean something to your firm.”

If you missed the quiz, you can still complete it here. And here are the full results.

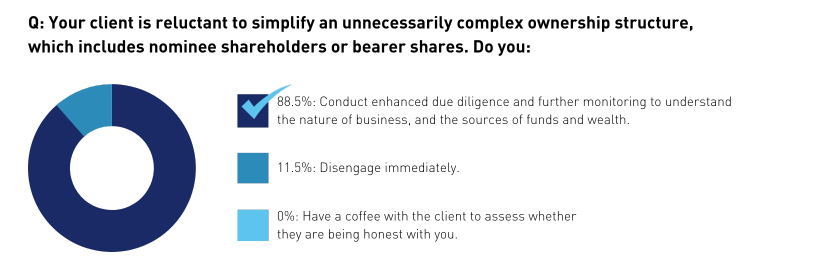

“If there is an unusually complex structure. that would almost certainly be a high-risk client and require enhanced due diligence,” says IFA Acting Director of Professional Standards Tim Pinkney. “The accountant would need to take care with onboarding, with enhanced due diligence and further checks.”

Through the enhanced due diligence process, the accountant should seek to understand the beneficial owners, the nature of the business, the source of funds and potentially the source of wealth of the beneficial owners.

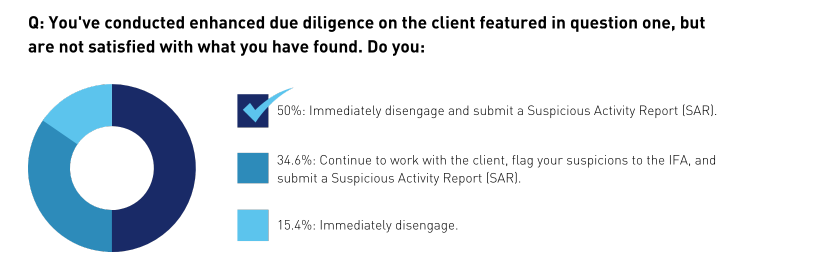

The good news is that everyone was partly correct. The bad news is that only half of readers would take the correct actions in this scenario.

“If they were unable to perform enhanced due diligence and satisfy themselves, then the accountant should not engage and must submit an SAR,” Pinkney says.

“This is an area that firms and practitioners struggle with. Some practitioners have told us that if they can not confirm the beneficial owners and perform due diligence, they just don't take on the business. But they should be submitting an SAR at that point.”

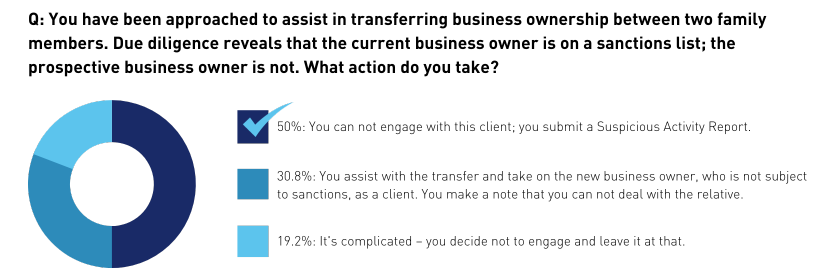

“This is not a scenario to get involved in,” Pinkney says. “The three in 10 readers who would assist in the business ownership transfer would be putting themselves at real risk by doing so.”

And while the big takeaway here is not to engage with someone on a sanctions list in any capacity, Pinkney offers a reminder: “My advice would be to submit a SAR as well if somebody came in and asked for that type of work”.

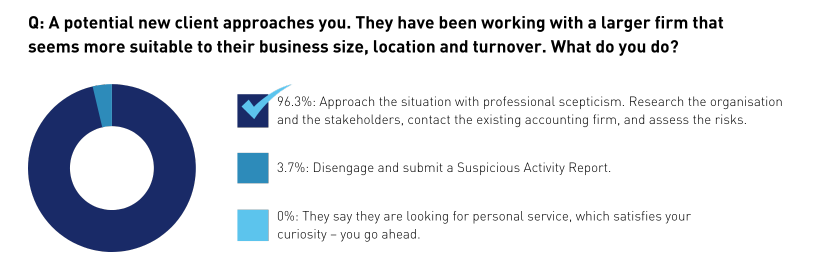

“Exercise professional scepticism,” says Pinkney. “It's one of my mantras and it applies to this situation.”

A starting point is to speak to the other accountant, and to sit down with the clients and get to the bottom of why they're moving.

“It could be as simple as wanting to move away from larger firms and their fees. Perhaps they've heard good things about your firm – but actually exercise professional scepticism and ask yourself why they came to you.”

Pinkney advises complementing these conversations with internet searches, looking for mentions in local media and getting a clear sense of the business profile. This can help paint a fuller picture of the services the business offers and their clientele.

“Consider what they actually do: Is that a high-risk area?” Pinkney says. “Or is there other risk involved in taking on this client that makes you uncomfortable? Is there a specialty that you aren’t familiar with? For instance, if the client is trading heavily in cryptocurrencies and you do not have the expertise in that, don't be afraid to say no.”

If the firm they are leaving looks after high-profile PEPs and has a range of specialisations on staff, Pinkney warns that a potential client may be shopping for a smaller firm that won’t scrutinise everything or fully understand an unfamiliar business model.

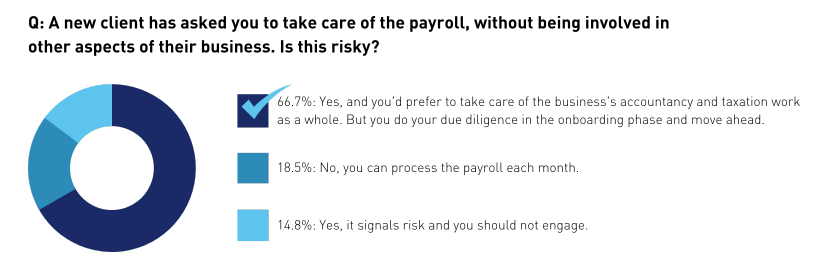

Pinkney advises accountants to take on as much of the accounting work for each client as possible. This not only makes commercial sense, it also gives a fuller picture of the business and its finances, which allows the accountant to recognise and assess risk.

So, while processing payroll is not a problem in itself, performing this function in isolation does carry risk that needs to be managed.

“In reviews, we often ask accountants to tell us about their controls with payroll,” Pinkney says.

“They will often tell me that they get the cash and they transfer it into the listed accounts – they just process it all. And when I ask what checks are performed on the people or accounts, many tell me that is the client's responsibility.”

Pinkney, not kidding about his mantra, emphasises the importance of professional scepticism in payroll processing. He suggests looking for issues that jump out, and working through a mental checklist:

“Building these processes into your general work can help you spot red flags.”

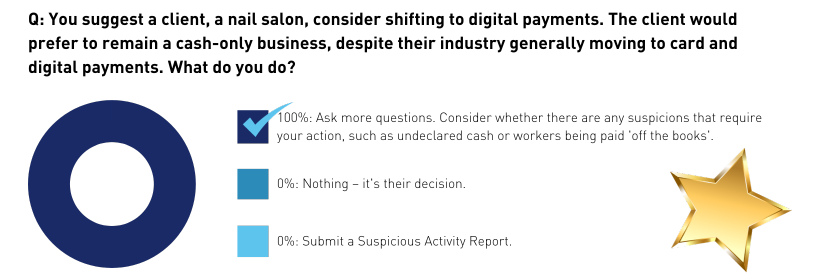

Every single reader was well on board with ‘exercise professional scepticism’ at this point.

“There might be good, valid reasons for them to stay in cash,” Pinkney says. “Maybe the cost of card transactions is such that a small shop might not want to take them on board. But if they are expanding and increasing their turnover, it should be a conversation that takes place.”

Professional scepticism means asking more questions, understanding the commercial reality of the business and validating the reasons for the decision.

“You're looking at the full model, trying to understand the bigger picture. Is all cash being declared? Are there people that are not necessarily going through the payroll? That could be symptomatic of somebody trying to keep costs down, but it also could be symptomatic of organised crime groups, human trafficking,” Pinkney says. “So professional scepticism is the key again.”