HMRC’s Octagon Green investigation: One key takeaway

It’s one thing for a company to face an HMRC investigation for tax evasion – and another to face such an...

READ MORE

Maybe not as a bank, but your own pension arrangements can help to meet your ever-present cash flow issues, which makes people realise that pensions are not so boring!

Businesses do not have to only use traditional lenders as their source of funding; sophisticated pension vehicles can help provide an alternative source of funds, while also helping to improve the member’s retirement prospects.

Despite government lending schemes such as the Coronavirus Business Interruption Loan Scheme (CBILS), the Coronavirus Large Business Interruption Loan Scheme (CLBILS) and the Bounce Back Loan Scheme (BBLS) ending for new applications since 31 March 2021, the requirement for loans and additional funding remains.

COVID-19 has caused huge strain on UK businesses. According to the Office of National Statistics 30.06 per cent of business owners believe they only have sufficient cash reserves to last for the next three months. As a result, many businesses have looked to source additional funding.

Since the above-mentioned lending schemes have come into place, over £75 billion of loans have been facilitated, but there are 660,809 applications that have not been approved (according to HM Treasury), up to 21 March 2021.

While the government-initiative Recovery Loan Scheme is available for business until 31 December 2021, thereafter (as an alternative) third-party loans from banking and non-banking institutions may then be used. Inevitably negotiations could be drawn out and interest rates might be comparatively high.

What if pensions were the answer to the problem?

Many of us may have pension entitlements scattered across multiple policies, but some may find that their combined values can facilitate pension investments which also provides cash injection to their business.

Sophisticated pension vehicles such as Self-Invested Personal Pensions (SIPP) and Small Self-Administered Schemes (SSAS) can assist as they have significant investment flexibility, meaning they are able to do the following:

Purchase commercial property

Pension schemes such as those above (SIPP or SSAS) can hold direct commercial property either outright or under joint ownership with another entity. This means the pension scheme can purchase the business premises from the individual’s company, which in return provides the company with a cash lump sum from the sale.

Although as a connected party, the company would have to pay market value rent to continue to tenant the business premises, the resulting rent would be paid into the individual’s own pension scheme, resulting in an investment return as a result of both income (rent) into the pension scheme as well as the potential for capital growth. Furthermore, any capital gains or income from the property within the pension scheme would not be subject to tax (according to current legislation).

In some circumstances, the property value may be higher than the pension scheme value. However, a SSAS can borrow up to 50 per cent of its net asset value (NAV), which can be either from a third party, i.e., bank, or a connected company/person. This increases the capacity for pension schemes to purchase such assets.

In some cases, a company may already have a mortgage on the property; however, an alternative arrangement could be for the pension scheme to essentially purchase the property and take on the loan (if within 50 per cent of NAV), which would redeem the company’s liability.

Lend money to connected company (loanback)

This method can help to provide an alternative loan to connected companies, where they are able to borrow up to 50 per cent of the pension scheme’s net asset value, which must be used for trading purposes. Other criteria include a maximum term of five years, security by way of a first legal charge over an allowable asset covering the capital and interest, and the loan must be repaid in at least equal and annual instalments of both capital and interest.

Such transactions can also be attractive for those who have achieved profits and are looking to reduce the level of corporation tax payable but still wish to retain the level of cash within the business.

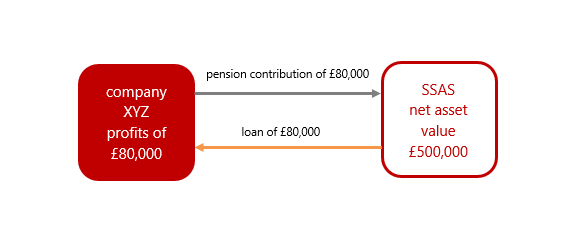

For example, Company XYZ Limited has achieved profits of £80,000, but due to ongoing cash flow concerns in relation to their trading activity, they wish to retain the £80,000 in cash. Company XYZ Limited is also a sponsoring employer of their own SSAS, which has an NAV of £500,000. A possible arrangement could be as follows:

As a result, the company essentially retains the cash in the form of a loan and potentially reduces the corporation tax payable on the profits due to the pension contributions made. Furthermore, any interest repayments could also be subject to corporation tax relief (up to level of profits*).

*Please note we are not tax advisers, and this is not formal advice; therefore, you should check with your accountant to see if tax is payable before making any arrangements.

A pension is not just your retirement pot; it can also be your helping hand

Pensions have become the forefront of any financial planning, where it is not just a pot for your retirement, but with the right flexibility involved, can help assist your business today.

[1] Bank of England: “Effective interest rates February 2021”, 29 March 2021

[2] HMRC: Pension Tax Manual 123200

Joshua Jones, Wealth Management Consultant of Mattioli Woods plc